A Breakdown of Business General Liability Insurance in 2025: Understanding the Landscape Ahead

As we fast forward to 2025, the world of business general liability insurance is evolving at a rapid pace. This article delves into the key trends, changes, coverage areas, and cost factors that will shape the landscape for businesses in the coming years.

Strap in as we explore the ins and outs of business general liability insurance in 2025.

Overview of Business General Liability Insurance

General liability insurance for businesses is a type of coverage that protects a company from financial losses resulting from claims of injury or damage caused to others by the business's operations, products, or employees. It is designed to cover legal fees, medical expenses, and damages that may arise in such situations.Having general liability insurance is crucial for businesses of all sizes as it helps protect them from potential lawsuits that could otherwise lead to significant financial losses.

Without this coverage, a business could face bankruptcy or closure due to the costs associated with legal defense and settlements.

Importance of Business General Liability Insurance

- General liability insurance provides financial protection against claims of bodily injury, property damage, and personal injury such as slander or libel.

- It helps maintain the reputation of a business by showing customers, partners, and investors that the company is prepared for unforeseen events and is financially responsible.

- Many contracts and leases require businesses to have general liability insurance to protect all parties involved in the business transaction.

Examples of Situations Where General Liability Insurance is Essential

- If a customer slips and falls on the business premises, general liability insurance can cover their medical expenses and potential legal fees.

- If a product sold by the business causes harm or injury to a customer, the insurance can help cover the costs of a potential lawsuit.

- In cases of property damage caused by the business's operations, general liability insurance can cover the repair or replacement costs.

Trends and Changes in Business General Liability Insurance by 2025

In the ever-evolving landscape of business general liability insurance, several trends and changes are expected to shape the industry by 2025. Advancements in technology, emerging risks, and regulatory shifts are key factors influencing how businesses approach liability insurance.

Impact of Technology on Business General Liability Insurance

Technology is poised to revolutionize the way businesses manage and mitigate risks covered by general liability insurance. The use of data analytics, artificial intelligence, and Internet of Things (IoT) devices can enhance risk assessment processes, leading to more personalized and cost-effective insurance solutions.

For instance, insurers may leverage real-time data from sensors to assess risks in commercial properties or use predictive analytics to forecast potential liabilities. As technology continues to advance, businesses can expect more tailored insurance products and streamlined claims processes.

Emerging Risks and Coverage Needs

As businesses evolve, new risks emerge that may not be adequately covered by traditional general liability policies. Cyber risks, environmental liabilities, and reputational harm are among the growing concerns that businesses need to address. Insurers are likely to offer specialized coverage options to protect against these evolving risks, such as cyber liability insurance or pollution legal liability insurance.

Businesses must stay vigilant and assess their coverage needs regularly to ensure they are adequately protected against emerging threats.

Regulatory Changes Impacting General Liability Insurance

Regulations governing general liability insurance are subject to change, potentially affecting how businesses procure and manage their insurance coverage. By 2025, we may see shifts in regulatory requirements related to liability limits, coverage mandates, or claims procedures. For businesses, staying informed about these regulatory changes and ensuring compliance with evolving standards will be crucial to maintaining adequate protection against liabilities.

Adapting to regulatory shifts proactively can help businesses avoid potential gaps in coverage and financial risks.

Coverage and Exclusions in Business General Liability Insurance Policies

Business general liability insurance policies provide essential coverage for businesses to protect themselves from financial risks associated with third-party claims. These policies typically include coverage for bodily injury, property damage, and personal and advertising injury. However, it's crucial for businesses to understand the common exclusions that may not be covered under these policies and how they can tailor their coverage to suit their specific needs.

Coverage Areas in Business General Liability Insurance Policies

- Bodily Injury: This coverage protects your business in case someone is injured on your property or as a result of your business operations.

- Property Damage: This coverage helps pay for damages to someone else's property caused by your business operations.

- Personal and Advertising Injury: This coverage protects your business against claims of slander, libel, copyright infringement, or false advertising.

Common Exclusions in Business General Liability Insurance Policies

- Professional Services: Business general liability insurance typically does not cover claims related to professional errors or negligence. Businesses that provide professional services may need to consider additional professional liability insurance.

- Intentional Acts: Claims arising from intentional acts or criminal activities are usually not covered under general liability insurance.

- Employee Injuries: Workers' compensation insurance is needed to cover injuries to employees while on the job, as general liability insurance excludes coverage for employee injuries.

Tailoring Coverage to Suit Specific Needs

- Reviewing Policy Limits: Businesses should assess their operations and risks to determine if the coverage limits in their general liability policy are adequate.

- Adding Endorsements: Businesses can add endorsements or riders to their policy to extend coverage for specific risks that are not covered by a standard policy.

- Consulting with an Insurance Professional: Working with an insurance agent or broker can help businesses understand their coverage options and customize a policy that meets their unique needs.

Cost Factors and Affordability of Business General Liability Insurance

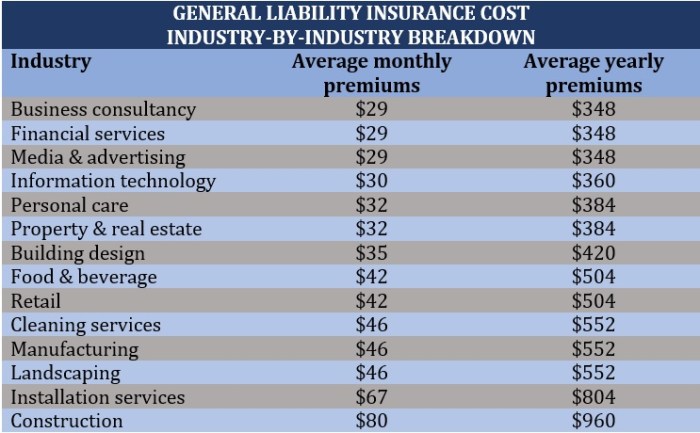

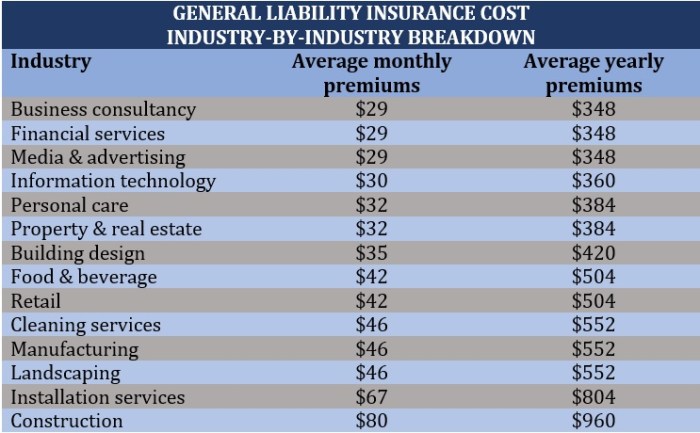

Business general liability insurance is a crucial investment for any business, but the cost can vary depending on several key factors. Understanding these factors and exploring ways to manage and reduce costs can help businesses make informed decisions.

Factors Influencing the Cost of General Liability Insurance

Several factors can influence the cost of business general liability insurance. These include:

- The size and type of the business

- The location of the business

- The coverage limits and deductibles chosen

- The industry-specific risks associated with the business

- The claims history of the business

Comparison of Pricing Models and Structures

Insurance providers offer different pricing models and structures for general liability insurance. These may include:

- Flat-rate pricing: Businesses pay a fixed premium regardless of their size or risk profile

- Pay-as-you-go pricing: Premiums are based on the actual risk exposure and can fluctuate based on business activities

- Bundled pricing: General liability insurance is bundled with other types of business insurance for a discounted rate

Tips for Managing and Reducing General Liability Insurance Costs

Businesses can take proactive steps to manage and reduce the cost of their general liability insurance. Some tips include:

- Implementing risk management strategies to reduce potential liabilities

- Shop around and compare quotes from multiple insurance providers

- Consider higher deductibles to lower premiums

- Review and update coverage limits based on business needs

- Bundle general liability insurance with other policies for potential discounts

- Invest in safety training and measures to reduce the likelihood of accidents

Conclusive Thoughts

In conclusion, the future of business general liability insurance in 2025 is a complex tapestry of emerging trends, evolving technology, and shifting regulations. Businesses must stay informed and adaptable to navigate this dynamic landscape successfully. Stay tuned for more insights and updates on this vital aspect of business protection.

FAQ Corner

What is the significance of general liability insurance for businesses?

General liability insurance protects businesses from financial loss due to claims of injury or property damage caused by their operations or products.

How can businesses customize their general liability insurance coverage?

Businesses can customize their coverage by adding endorsements or riders to their policy to meet specific needs not covered by the standard policy.

What are some common exclusions in business general liability insurance policies?

Common exclusions include coverage for professional errors, intentional acts, pollution, and employment-related claims.