Affordable Private Health Cover Options for Small Companies: A Comprehensive Guide

Affordable Private Health Cover Options for Small Companies sets the stage for this informative exploration, shedding light on the crucial aspects that impact small businesses and their employees. From the importance of private health cover to strategies for cost-saving, this guide delves into the complexities of navigating healthcare options for smaller enterprises.

Affordable Private Health Cover Options for Small Companies

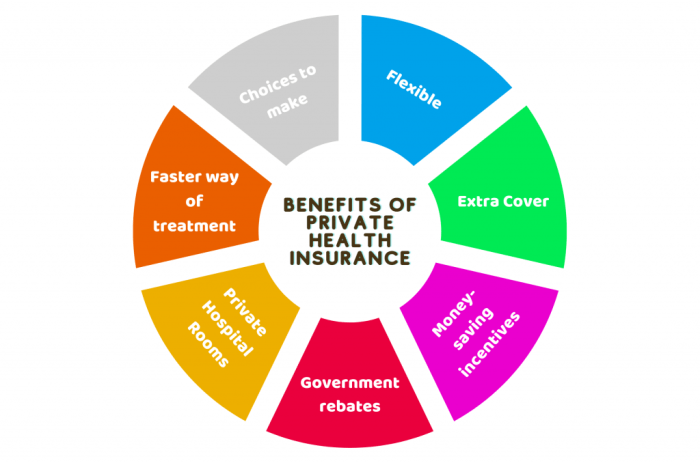

Private health cover is essential for small companies as it helps in ensuring the well-being of their employees. It allows employees to access quality healthcare services without the financial burden, leading to increased productivity and job satisfaction.

Key Factors to Consider when Choosing Health Cover Options

When selecting health cover options for small companies, it is crucial to consider the following key factors:

- Cost-effectiveness: Opt for plans that provide adequate coverage at a reasonable cost to ensure affordability for both the company and employees.

- Coverage benefits: Evaluate the extent of coverage offered, including hospitalization, outpatient services, and pre-existing conditions, to meet the healthcare needs of employees.

- Network of healthcare providers: Choose plans with a wide network of healthcare providers to ensure accessibility and convenience for employees seeking medical treatment.

- Flexibility: Look for plans that offer flexibility in terms of adding or removing coverage options based on the changing needs of the company and employees.

Challenges Faced by Small Companies in Providing Affordable Health Cover

Small companies encounter several challenges when it comes to offering affordable health cover to their employees:

- Limited bargaining power: Small companies may not have the negotiating leverage to secure competitive rates from insurance providers, resulting in higher premiums.

- Administrative burden: Managing health cover options and dealing with insurance paperwork can be overwhelming for small businesses with limited resources and expertise.

- Employee turnover: High turnover rates can impact the stability of health cover plans, making it challenging for small companies to maintain consistent coverage for employees.

- Compliance requirements: Small companies must comply with regulatory standards and legal obligations related to health cover, adding to the complexity and cost of providing healthcare benefits.

Types of Affordable Private Health Cover Options

When it comes to providing health cover options for small companies, there are a few different types of plans that can be considered. These options can vary in terms of cost, coverage, and flexibility, so it's important to choose the right plan that fits the needs of the company and its employees.

Group Health Insurance vs. Individual Health Plans

Group health insurance and individual health plans are two common options for small companies looking to provide health cover for their employees. Here's a comparison of the benefits of each:

- Group Health Insurance:

- Cost-effective: Group plans often have lower premiums compared to individual plans.

- Broader coverage: Group plans typically offer more comprehensive coverage options.

- Easy administration: Group plans are easier to manage as they cover all employees under one policy.

- Individual Health Plans:

- Customizable: Employees can choose a plan that best fits their individual needs.

- Portability: Employees can take their plan with them if they leave the company.

- Flexibility: Individual plans offer more flexibility in terms of coverage options.

Cost-Effective Health Cover Options

For small businesses looking for cost-effective health cover options, there are a few plans tailored to meet their needs:

- Health Savings Accounts (HSAs):

- Allows employees to contribute pre-tax dollars to a savings account to pay for medical expenses.

- Can be paired with a high-deductible health plan for added cost savings.

- Health Reimbursement Arrangements (HRAs):

- Employers fund an account to reimburse employees for medical expenses.

- Offers flexibility in terms of coverage and cost control.

Strategies to Lower Costs of Health Cover for Small Companies

When it comes to offering private health cover for employees in small companies, cost-saving strategies are crucial to ensure affordability without compromising on quality. Here are some effective ways that small companies can implement to lower the costs of health cover:

Negotiating with Insurance Providers

One effective strategy for small companies to lower the costs of health cover is to negotiate with insurance providers. By comparing quotes from different providers and leveraging the bargaining power of the company, it is possible to secure affordable rates for health cover.

It is essential to highlight the specific needs of the company and the number of employees to get customized and cost-effective health cover options.

Implementing Wellness Programs

Wellness programs play a significant role in reducing healthcare costs for small businesses. By promoting employee health and well-being through initiatives such as fitness classes, mental health support, and healthy eating programs, companies can prevent illnesses and reduce the frequency of medical claims.

This proactive approach not only lowers healthcare costs but also boosts employee morale and productivity.

Last Recap

In conclusion, Affordable Private Health Cover Options for Small Companies encapsulates the essence of providing quality healthcare benefits to employees while balancing the financial constraints faced by small businesses. With a focus on practical solutions and informed decision-making, this guide equips small company owners with the knowledge needed to make sound choices regarding health cover options.

FAQ Corner

What are the key factors small companies should consider when choosing health cover options?

Small businesses should consider factors like cost, coverage options, network of healthcare providers, and the specific needs of their employees when selecting health cover options.

How can small companies negotiate with insurance providers to secure affordable rates for health cover?

Small companies can negotiate by bundling services, exploring high-deductible plans, or leveraging their employee pool for group rates to secure more affordable health cover options.

What role do wellness programs play in reducing healthcare costs for small businesses?

Wellness programs can help reduce healthcare costs for small businesses by promoting preventive care, healthy lifestyle choices, and early intervention, which can lead to lower medical expenses in the long run.